- info@rockwoodinvest.com

- (858) 461-4499

Independence

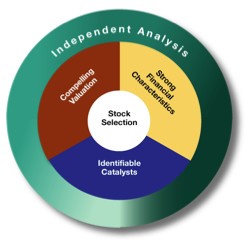

Rockwood Investment Counsel is an independent investment boutique specializing in Small Cap security investing. We apply a fundamental, bottom-up research driven approach to selecting which investments to add to our client’s portfolio. We are rigorous in our analysis of a company’s revenue, cash from operations, cash flow, margins and prospects for growth, to name just a few of the metrics we believe are important to understanding a company. We apply industry appropriate valuation methods to the analysis of each company. We talk to management of each company we consider for addition to the portfolio – we want to make sure we understand the company.

We do not rely on Wall Street research for our investment ideas or in our analysis. We do not invest to an index. We are indifferent to whether popular Wall Street firms like an investment. We do our own earnings estimates and based on various metrics, derive what we consider a true valuation for the investment, independent of Wall Street noise.

Example of Key Valuation Criteria

• Selling at attractive discount to intrinsic value

• Relatively low multiples of earnings, book, EBITDA, cash flow, and/or sales

• Attractive relative to peers, industry or companies with a similar business model.